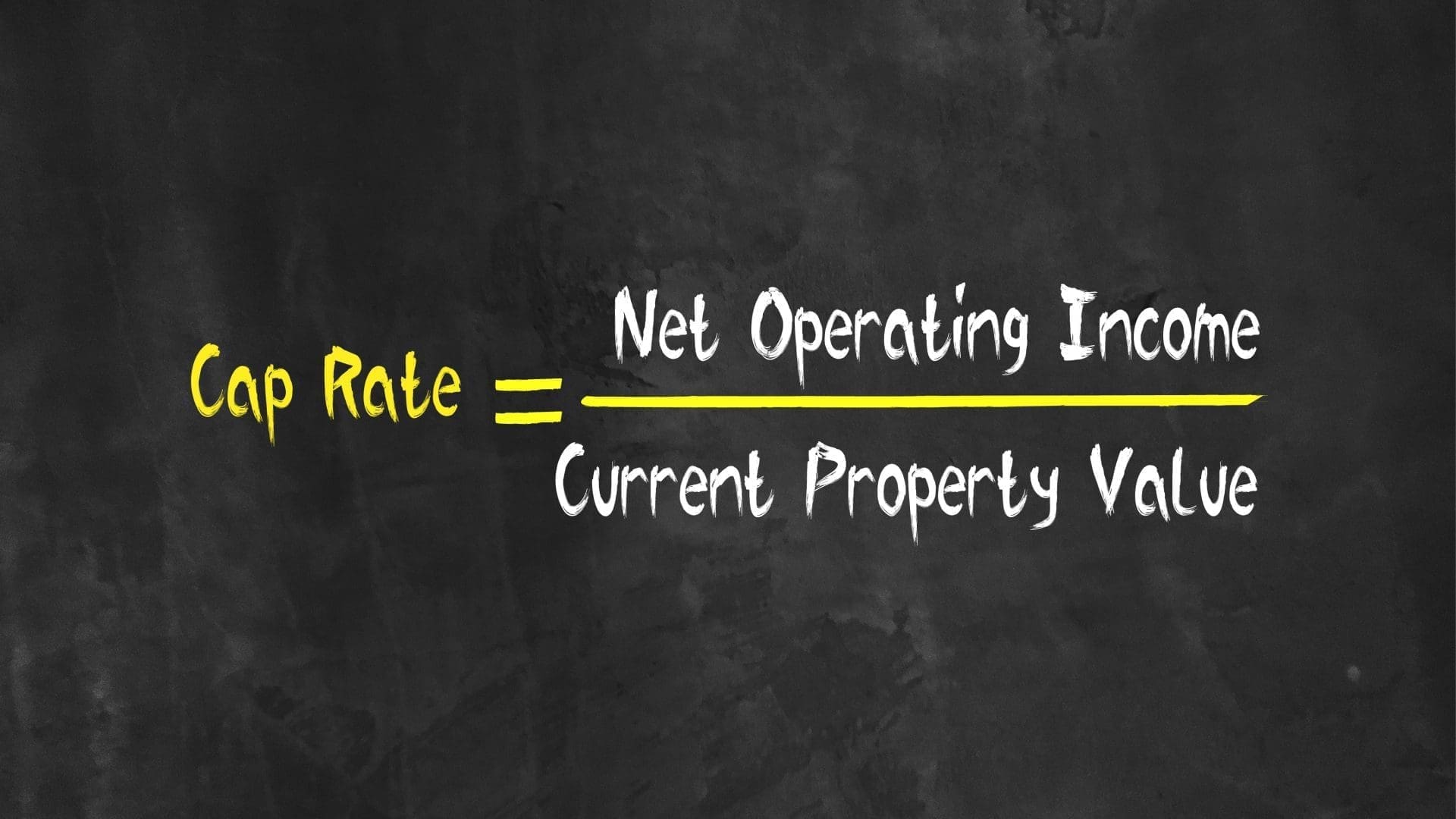

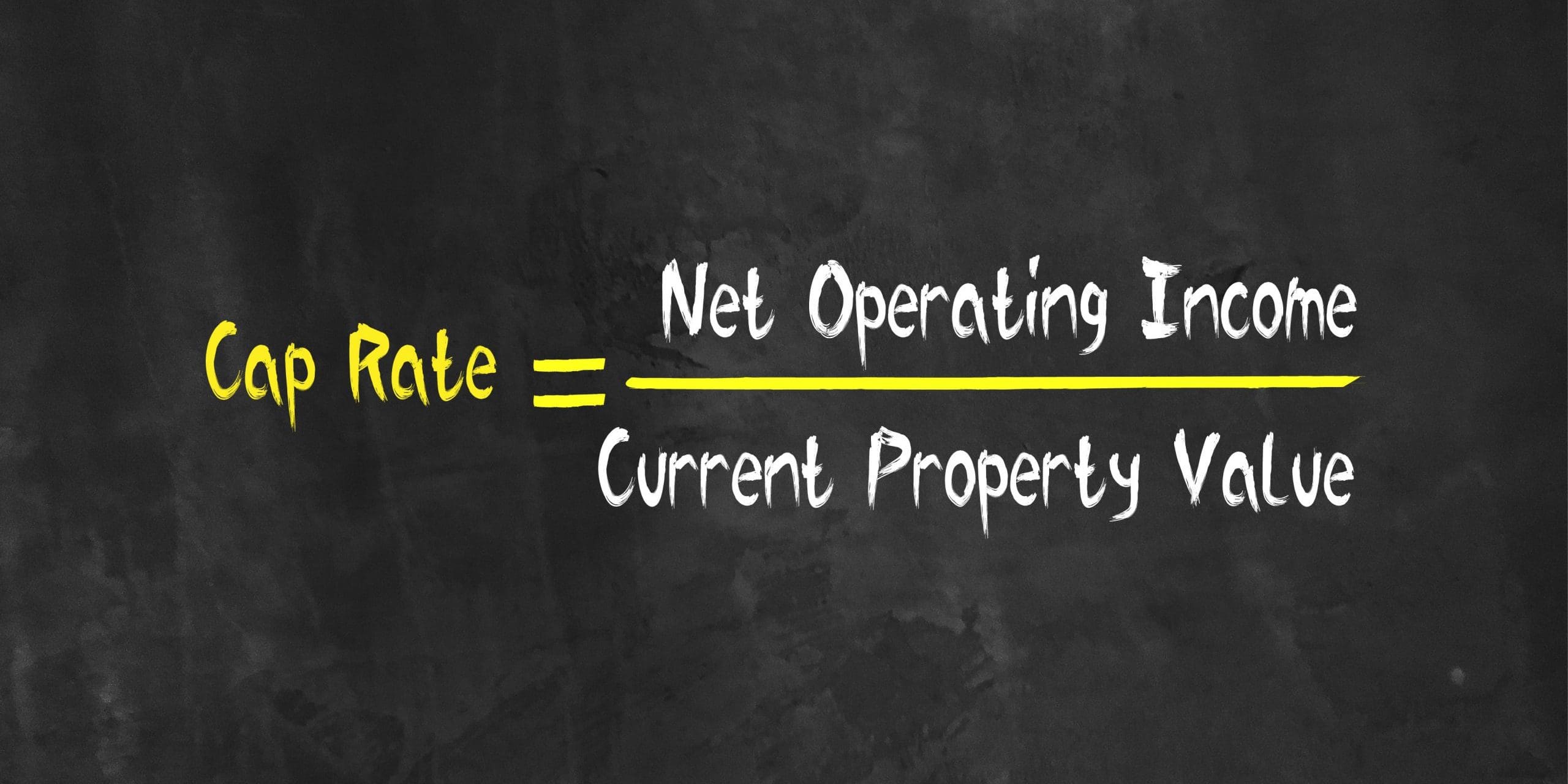

A popular metric to determine the value of a commercial real estate deal is the capitalization rate. Also known as the cap rate, this metric is useful in determining how much an investor may want to pay for a property in order to receive a certain return on the money invested.

First, we need to know the net operating income of the property. The NOI is simply the yearly rent received minus costs of ownership like taxes, general property maintenance, and insurance.

The price is how much the property owner paid or will pay, for the property.

To determine the cap rate, we will divide the NOI by the price. For example, a property with an NOI of $80,000 and an asking price of $1,000,000, would be 80,000 divided by 1,000,000.

80,000 divided by one million is .08, giving us an 8% cap rate.

The 8% cap rate gives an indication of the amount of risk the property holds and is also helpful in determining the value of an investment. In general, we can assume that a lower cap rate represents less risk for an investor, however, it will then provide less return.

Investors and sellers can also utilize the cap rate to help determine the price of a commercial property.

If the investor or seller wants an “8-cap” or 8% cap rate, just flip the formula and divide the NOI by the desired cap rate. In this case, 80,000 divided by 0.08.

This gives us a price of $1,000,000. One can use this figure to inform negotiations or determine whether the list price represents an acceptable risk level.

In general, we can assume…

Lower Cap Rate = Higher Price

Higher Cap Rate = Lower Price

How To Use Cap Rates

Before throwing numbers into the formula and planning your real estate empire, understand cap rates are correlated to risk.

In general, the higher the cap rate, the higher risk. In other words, a high cap rate means your asset needs to be priced low, to create a higher rate of return. This typically points to a riskier investment. The key to utilizing cap rates effectively is comparing them to other cap rates in your market.

Take note. An investment opportunity with a high cap rate may not be the best investment for you if you are not able to tolerate higher risk levels despite the higher potential return on investment.

Trending

Now that we have gone over what the cap rate tells us, let’s explore the factors that inform this metric and how they can be used to evaluate a property.

I know it is cliché, but remember…location, location, location! The reality is location has a profound effect on a property’s cap rate. A property situated in a hot location with heavy traffic will have a vastly different cap rate than a similar property located in a less desirable location.

This does not mean property in downtown Albany will necessarily be a better investment than a similar property in Clifton Park. It all depends on the market. Markets with higher demand will have higher-priced properties and higher potential operating income. Markets can be volatile and will change over time.

As a real estate investor, you must have access to the local knowledge of the underlying market fundamentals of your area. A low cap rate may be worthwhile if you know Amazon is building a distribution center nearby, or a major development project has been approved around the corner.

What’s a good cap rate?

This is a loaded question with no single answer. Like investing in the stock market, it all depends on risk tolerance.

Risk tolerant investors may not even look at a property with a cap rate of less than 10% or higher. Others will only consider properties with lower single-digit cap rates. Again, there are a lot of varying factors involved. A cap rate of around 8% might be considered fantastic in certain markets, but it may not produce enough return for certain buyers.

For many investors – people who might not be able to tolerate excessive risk but still want to see a reasonable ROI on their investment – a cap rate between 4% and 6% may be optimal. In many markets, this range yields plenty of potential investment opportunities and is stable enough to maintain a solid return without undue exposure to risk, and minimal ownership input.

Again, this is completely dependent on the investor’s criteria as well as the real estate markets you are looking to invest in. You may want to consider consulting with a licensed real estate professional at NAI Platform to assist you in developing your investment strategy.

Conclusion

While useful, it is important to remember the cap rate is just a tool. It should be used as part of a full analysis of the makeup of a potential deal – it does not account for appreciation, growth, demand, or amortization. For instance, your cash flow situation may be completely different than another investor on the same property. A profitable asset for one investor may very well be a liability for another

Even so, regardless of your individual financial position, a property’s cap rate provides information to help you determine the income potential relative to the associated risk in the investment. It will be integral in helping you consistently and accurately evaluate profit potential. The cap rate is a fundamental metric to master if are looking to invest in real estate and build wealth.

NAI Platform is the leading choice for commercial real estate buyers, sellers, owners, tenants, and developers in Upstate New York thanks to our depth of expertise across all property types and services. Contact us today to see how we can help you navigate the nuances of making a deal in commercial real estate.